Let's start the conversation.

10 Mistakes when selling your home

- Not clearing up title issues - if there are liens on your home, active boundary disputes, ownership issues, etc., these can easily derail your sale if they’re not taken care of proactively. Talk to me (your agent) early on and connect with the title company/an attorney to help.

- Not disclosing problems with the house - You are legally obligated to disclose any “material defects” you’re aware of to prospective buyers. While you may be afraid that buyers' awareness of an issue will scare them away, I can promise that it’s much messier when they buy not knowing about a big problem you were aware of. Unless you like lawsuits?

- Leaving deferred maintenance items undone - You probably hate the idea of pouring money into your home just for someone else to enjoy it…but most of today’s buyers really want a move-in ready home. Something as small as a non-functional furnace or leaking bathtub can really turn off a potential buyer—or make them wonder what else might be wrong with the house.

- Having heavy scents in your home - Most people get used to the smells in their house, but any heavy smells (Glade plug-ins, strong candles, kitty litter, wet dog) can be a big turn-off to buyers when they walk in. It’s best to start unplug and clean out at least 2 weeks before listing to make sure scents dissipate!

- Not taking advantage of small spruce-up opportunities - It’s totally worth springing for a “juge” on landscaping, house cleaning, light/lightbulb changing, etc. (and I'll always advise you on the best bang for your buck). Little things can make a big difference in first impression. We’re going for neutral, bright, clean, well-maintained!

- Not leaving the house for at least the first 5 days it’s on the market - The ideal, of course, is for a home to be vacant and staged if it's in the Seattle market. If that’s not possible, at least consider leaving the house to stay at an AirBnb or with a friend for the first ~5 days on market. It’s very disruptive for you to have to constantly clean and vacate your home whenever a showing is scheduled. On the flip side, homes show best when they feel very “aspirationally” lived-in, and when it’s easy for brokers to set touring times.

- Not taking advantage of good staging - It’s one of the hardest expenses for home sellers to swallow, but in our area, staging your house ($2,000-8,000) can have a big impact on selling time and buyer interest. Staging designers are great at optimizing space and creating a clean but warm aesthetic. I’ve seen buyers’ eyes light up differently in a staged versus un-staged home so many times. You’ll make your money back 100%.

- Overpricing - It’s tempting to assume the Zestimate is king, or that you can surely get the exact price your neighbor’s house fetched last year. But proper pricing means working with your broker (me) to delve deep into the CURRENT, hyper-local market that is relevant to your home. You can’t set the price based on what you want to net or what you think others should pay for it and expect a swift sale; you have to be grounded and realistic!

- Taking a low offer or lack of interest in the home personally - It’s so hard to be objective when listing a home you’ve loved and put energy/work into. You want other people to see how great it is and fall in love with it—or be willing to pay a ton. The reality is that everyone is different, and buyers may be comparing your home to a similar but slightly better/newer house on the market. You just can’t control how they feel, and taking a low offer personally will only leave you frustrated and disappointed. Instead, try to keep your long-term goals in mind and remember: You only need one buyer to get it sold!

- Not setting reasonable expectations overall - This is a tough one! I spend a lot of energy setting solid expectations with my sellers, understanding the realities of their home through buyers’ eyes, the current market, any logistical obstacles, etc. It’s also important to remember that it’s NORMAL to have bumps in the road during the selling process. With our eye on the prize, we can work together to stay grounded in the path forward and respond to challenges with grace.

Every home is different, every market is different, and every situation is different. But with these rules in mind, you can have confidence that you're approaching your home sale with wisdom!

Ready for support selling your home?

Home Digest

We publish a fun custom "magazine," the Eva Canary Homes Home Digest, each Summer & Winter. It's chock-full of resources, fun things to do around the Puget Sound, and ideas to spruce up your home. If you're already on our mailing list, you'll get each issue dropped in your snail mailbox in June & December. Not on the list or not sure? Sign up!

I recently completed my coursework and certification for the REALTOR® Association's Senior Real Estate Specialist Designation. After working with my sister to guide my mom through the sale of her condo and transition into an independent living facility, I wanted to have even more resources at my fingertips to help folks in similar situations.

I learned a lot about the changing concept of retirement, the trends among various generations, and some of the best practices/pitfalls when working with seniors and their families. With Baby Boomers entering retirement years en masse, our family and neighbors will need a lot of support!

Some interesting facts:

- More than 75% of adults age 55+ own their own homes.

- 52% of Americans age 65-74 were still in the workforce as of 2019.

- Census projections expect 3.3 million people in the U.S will be age 90+ by 2030.

- More than 80% of people 50-69 own a smart phone and use it daily; over age 79, it's about 70%.

What living situation will best match the needs of you or your senior loved ones as we/they age?

I am working on a set of tools to help guide seniors and their families through housing-related transitions. There is a lot to navigate, from finding the right destination, to legal/tax implications and care decisions. I'm committed to supporting my senior clients in any way I can!

In the meantime, there are plenty of helpful resources as folks are contemplating a move.

A great place to start:

- Tips for downsizing & decluttering

- Help adapting your home for universal accessibility

- Local care concierge to assist with housing placement (we used Sylvana for my mom and she was fantastic!)

- Overview of HUD's Reverse Mortgage (HECM) program, plus FAQ

- AARP's Livability Index

- National Council on Aging

Reach out to me anytime for a consult or early steps in long-range planning. I'm here for you!

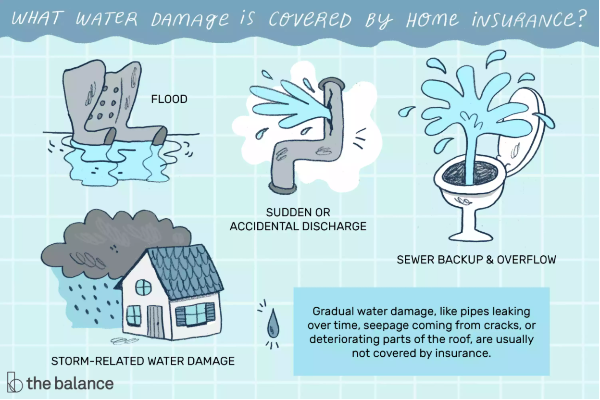

WATER, WATER EVERYWHERE

What to know about damage & insurance

URGENT REMINDER: Slow leaks may NOT be covered by your homeowner's insurance! Every time Jeffrey does a home inspection for my clients, I'm reminded that most people leave the standard-issue plastic water hoses on their washing machine—and this is a potentially dangerous oversight (replace with this type). This was reaffirmed in a recent conversation with an insurance agent, where he offered additional "seepage & leakage coverage" for slow leaks of water pipes, toilets, etc. because they're NOT covered by the standard policy. Home insurance generally focuses on "sudden and accidental damage," not the effects of long-standing problems that technically could have been corrected through proactive maintenance or upgrading systems. Yikes!

How to make sure you're covered:

- Conduct your own home audit or bring in a pro (home inspector, plumber, etc.) to identify any possible issues that might lead to water or mold damage. Read about some potential causes.

- Make fixes/upgrades that will help protect you against future uncovered damage—and consider that a few hundred or a couple thousand dollars spent now might save you tens of thousands later.

- Call your home insurance broker/agent to make sure you're covered for longer-term issues or understand what's NOT covered.

I'm always here if you need to talk through options or want recommendations for professional support.

WORKING WITH CONTRACTORS

WORKING WITH CONTRACTORS

Save your sanity

Hiring and managing contractors and sub-contractors for home remodel work can be intense; there is an overwhelming amount of choice, then hundreds of small decisions as projects progress and present challenges. The trick to staying grounded throughout? Make a plan ahead of time—but then be ready to flex.

My top 10 tips for contractor success:

- Get everything in writing, including bids & work changes.

- Ask about payment options, including cash discounts & installment options.

- Add a 30% buffer to any estimate (time AND money).

- Ask who will be performing the actual work—and how they'll be supervised.

- Touch base with your contractor weekly (by phone) to stay on course.

- Update any estimate after 6 months of lag to make sure it's still relevant.

- Check references for contractors on the big projects. Every time!

- Ask if any parts of the job are new to the vendor, and their plan of attack.

- Ask if there are money-saving options for either product or process.

- Plan for a LOT of dust! Cover everything and expect to clean.

BONUS: Best practices to avoid frustration...

- Plan early - Start researching options and contacting [several] vendors as far in advance as possible. Don't forget to research which supplies you might need and any permit or sub-contractor considerations.

- Look for opportunistic gaps - Is your job "too small" for contractors or are they booked out super far? Consider asking whether they can break it up into smaller pieces to fit in around other people's jobs.

- Pre-order supplies - Make sure to share your vision with your contractor ASAP and suss out any supplies you need to order or request as early as possible. Also consider using the same materials as your contractor's other client (and bundling an order) to save time and money.

- Be flexible - Things will be delayed. Sub-contractors may fall through. The key here is flexibility and reasonable expectations; you may have to adjust mid-job, but focus on the relief you'll feel when it's done.

- Have a Plan B - Make sure to check in frequently with vendors about impending snafus, status of materials, etc., so you can change your back-up plans when needed. Likewise, you may have dreamed of replacing ALL of your appliances at the same time, but you may have to settle for the fridge now and the rest later.

- More tips here and here

It's helpful to remember that vendors are just as stressed as we are. They want to deliver and hate snafus, but problem solving is their job. Ours? Be clear, be kind, be adaptable! I'm here if you need support...

Whether you're feeling anxious after watching a disaster unfold in another part of the country/world or you've just experienced a crisis yourself, you suddenly feel more motivated to get that disaster plan and resources assembled! So where to start?

- Run through the disaster preparedness checklists from a place like Good Housekeeping or Ready.gov.

- Connect to your local resources, including the City of Seattle Emergency Management Hub.

- Talk with your family, friends, and neighbors to understand your collective resources and make a plan in case of emergencies—and make sure you get everyone's contact information!

- Make a calendar reminder to check your supplies at least once per year, discarding expired food, replacing batteries as needed, and making sure everything is in working order.

- Consider what might make YOU feel safe in a crisis. Is it making sure your pet is cared for? Knowing how to contact your elderly mother? Having the medication you may need? You might want to take special measures to ensure these boxes are checked for your peace of mind.

There are so many resources for emergency/crisis/disaster preparedness online and through local city governments. Which have you found most helpful?

Taking the temperature

Following on last month's graph, we can see that sale price versus list price %—rather than starting to dive precipitously from September to October—stayed about steady this fall. Don't let that mislead you, though: While there are still wildly competitive homes going under contract (16 offers last week on a house in Wedgwood, 23 in Wallingford), home prices have flattened compared to the insane gains of the spring.

Mortgage interest rates have also fluctuated a touch more than expected; as of this week, they're back down below 3% for conforming (Fannie/Freddie-backed) loans, so it remains to be seen whether they'll stay under 4% for all of 2022.

I expect another HOT spring, but as with the last 2 years...I think the one thing we have learned to expect is the unexpected! Ping me anytime to talk numbers...

Rather than the typical “move-up” buyer of the past, who sold their previous home upon buying a larger one, these days many Seattle-ites [who can afford it] are instead turning their first home into a rental. There’s a LOT to keep in mind, however, when making the change—including regulations on short-term rentals, the city’s RRIO program, and current state & local laws.

For instance, here are some recent changes to landlord-tenant laws, in effect as of November 7th:

- Required notice for rent increases changed from 60 days to 180 days.

- Requirement for landlords to pay equal to three months of rent for low-income tenants who depart after rent increases of 10% or more.

- Any term lease signed prior to 11/7 is “grandfathered” in until the next renewal.

With frequent shifts in the sands of rental property ownership, I always suggest that clients talk with the experts before launching their own rental: a real estate lawyer who specializes in investments and/or a knowledgeable property manager. And while you’re at it, go beyond the uber-political headlines to understand the true history, context, and intent around landlord-tenant laws in our area.

Ready to go deeper on the renter protection debate? Start here.

COUNTERS & FAUCETS & FRIDGES, OH MY!

- I made a Pinterest board (see above, I’m not afraid to be hipster basic), which most contractors and designers say is the best place to start collecting inspiration and creating a cohesive vision.

- I created a rough budget ($10-12k) after talking with friends, colleagues, and inspectors, and reading way too many blogs.

- I reached out to Wes Sisk at Brave Element to get started. He specializes in installing Ikea cabinet systems with custom elements, like the forest green Semihandmade cabinet fronts I selected.

- During a masked measurement session, Wes helped me make some key decisions, answer big questions (especially sourcing), and make a plan.

- Then, it was on to my design…

New kitchen ETA: Mid-November. Stay tuned for some videos/posts/updates and feel free to reach out with questions if you’re starting your own remodel!

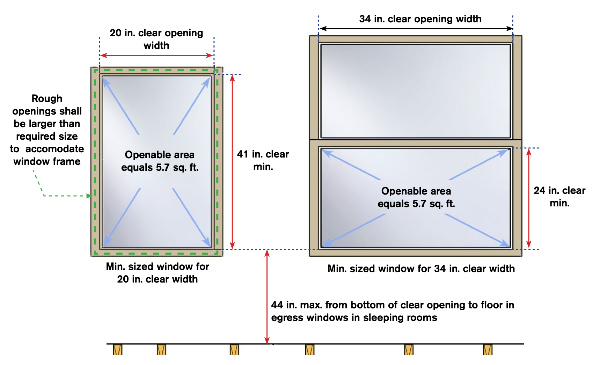

THE WAY OUT

Code requirements for egress

An egress window is large enough for entry or exit in case of an emergency. If you're finishing a basement or adding a bedroom, you may want to take into account the building code for both safety and resale value. Does that mean a basement bedroom without an "egress-able" window is a big problem? Not necessarily. Peer agents, appraisers, and builders alike can't seem to agree on how important a code-adherent bedroom is for tax and/or market value—but if you have the opportunity to add a larger window + exterior window well or upgrade, why not suss it out?

Here are the requirements per the International Building Code (and Seattle's Department of Construction and Inspections):

- Minimum width of opening: 20 in.

- Minimum height of opening: 24 in.

- Minimum net clear opening: 5.7 sq. ft. (5.0 sq. ft. for ground floor)

- Maximum sill height above floor: 44 in. (can also be achieved with a built-in step in many cases)

Curious what it would take to make your retrofit your bedroom window? Start with a contractor who does foundation and/or general contracting work and get multiple quotes! Hoffman Rebuilding, After the Fire Construction, and Wu Construction are my go-tos. What are yours?

Here are some more helpful notes on finishing your basement/adding the right windows from Hammer & Hand Construction, Owen Henry Windows, and GreenBuilt NW.

While we're talking planning...with contractors scheduling months out and remodel prices higher than ever, it pays to figure out exactly what you want before you embark on a project while being flexible later. I highly recommend starting with a floor plan (done by an appraiser or photographer) or "as-built sketch" (done by an architect, engineer, or house designer). The former costs as little as $150 and allows you to get a general sense of space/layout and play, while the full as-built may be sufficient for builders to use for their work (and may be several hundred or up to $2000). Either way, it pays to visualize that layout you *think* will be perfect. In the case of my house, Grant and I took several iterations to get the right flow for our daylight basement. Ping me for floor plan resources!