WATER, WATER EVERYWHERE

What to know about damage & insurance

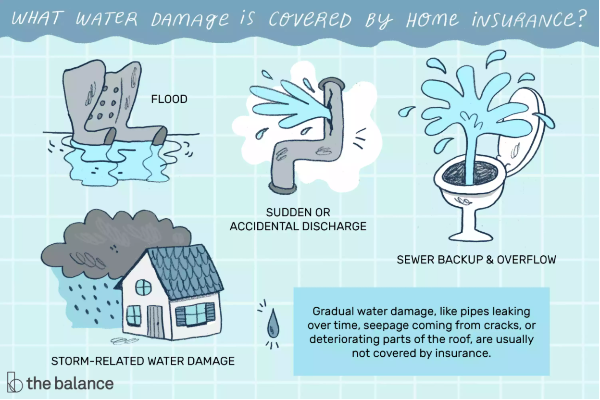

URGENT REMINDER: Slow leaks may NOT be covered by your homeowner's insurance! Every time Jeffrey does a home inspection for my clients, I'm reminded that most people leave the standard-issue plastic water hoses on their washing machine—and this is a potentially dangerous oversight (replace with this type). This was reaffirmed in a recent conversation with an insurance agent, where he offered additional "seepage & leakage coverage" for slow leaks of water pipes, toilets, etc. because they're NOT covered by the standard policy. Home insurance generally focuses on "sudden and accidental damage," not the effects of long-standing problems that technically could have been corrected through proactive maintenance or upgrading systems. Yikes!

How to make sure you're covered:

- Conduct your own home audit or bring in a pro (home inspector, plumber, etc.) to identify any possible issues that might lead to water or mold damage. Read about some potential causes.

- Make fixes/upgrades that will help protect you against future uncovered damage—and consider that a few hundred or a couple thousand dollars spent now might save you tens of thousands later.

- Call your home insurance broker/agent to make sure you're covered for longer-term issues or understand what's NOT covered.

I'm always here if you need to talk through options or want recommendations for professional support.